Polymer Electrolyte Fuel Cells Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Forecasts. Explore Key Trends, Regional Insights, and Strategic Opportunities Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Polymer Electrolyte Fuel Cells

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Opportunities

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

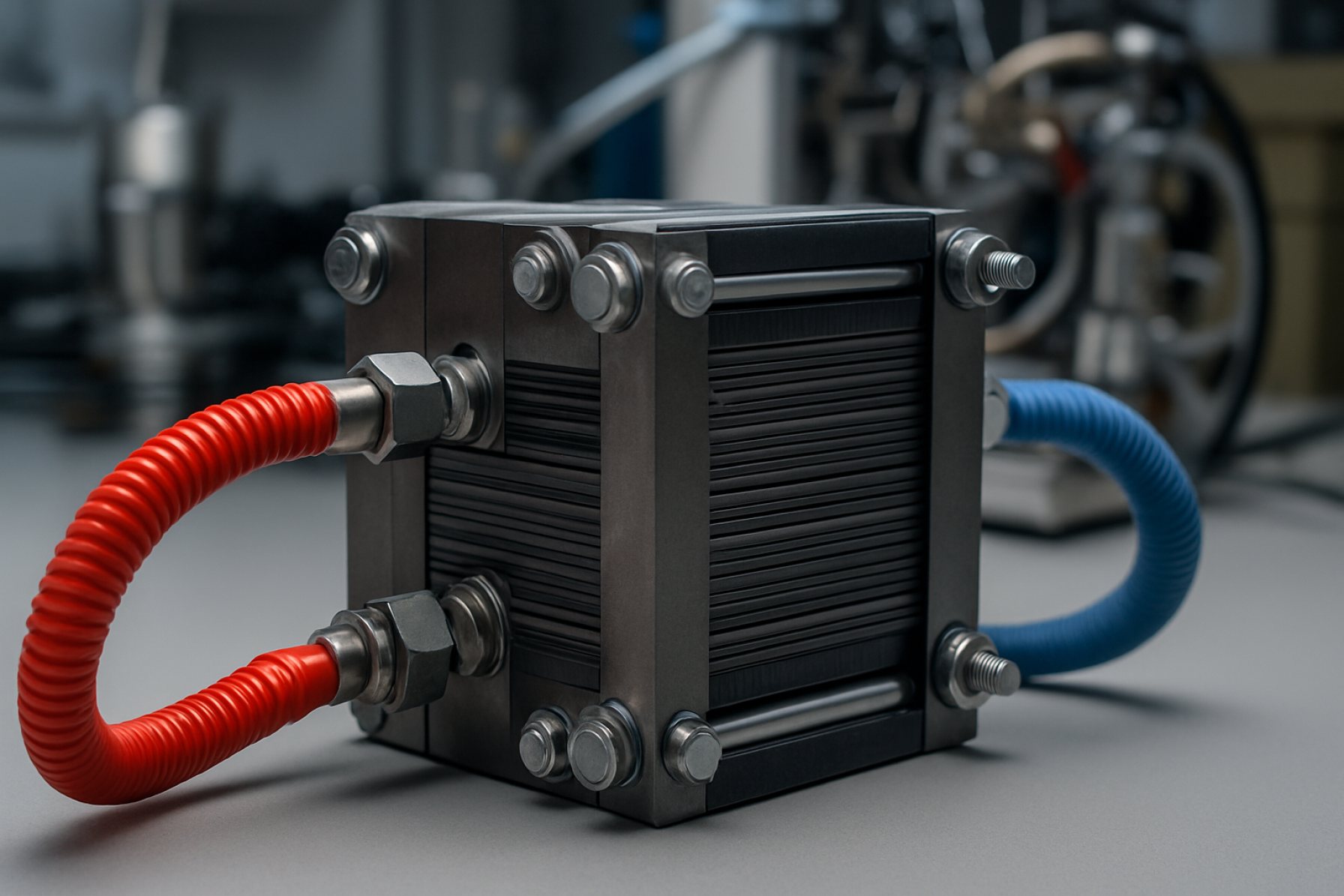

Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), are a leading technology in the fuel cell market, characterized by their use of a solid polymer electrolyte and their ability to operate at relatively low temperatures (typically 60–80°C). These attributes make PEFCs particularly suitable for transportation, portable, and stationary power applications. The global market for PEFCs is experiencing robust growth, driven by increasing demand for clean energy solutions, government incentives, and advancements in fuel cell technology.

According to recent market analyses, the global fuel cell market is projected to reach USD 8.7 billion by 2025, with PEFCs accounting for a significant share due to their widespread adoption in automotive and backup power sectors. The Asia-Pacific region, led by countries such as Japan, South Korea, and China, dominates the market, propelled by strong government support, ambitious hydrogen strategies, and the presence of major automotive manufacturers investing in fuel cell electric vehicles (FCEVs) MarketsandMarkets. Europe and North America are also witnessing increased deployment, particularly in public transportation and distributed energy systems.

Key industry players such as Ballard Power Systems, Plug Power, and Toyota Motor Corporation are at the forefront of PEFC innovation, focusing on improving durability, reducing costs, and scaling up production. Recent advancements include the development of more robust membrane materials, enhanced catalyst performance, and integration with renewable hydrogen production, which collectively address the challenges of cost and infrastructure.

Government policies and funding initiatives are pivotal in shaping the PEFC market landscape. For instance, the European Union’s Hydrogen Strategy and Japan’s “Basic Hydrogen Strategy” are accelerating the deployment of hydrogen infrastructure and fuel cell technologies European Commission. In the United States, the Department of Energy continues to support R&D and demonstration projects for fuel cell vehicles and stationary applications U.S. Department of Energy.

In summary, the PEFC market in 2025 is poised for significant expansion, underpinned by technological progress, supportive policy frameworks, and growing commercial adoption across multiple sectors. The convergence of these factors is expected to further solidify PEFCs as a cornerstone of the global transition to sustainable energy systems.

Key Technology Trends in Polymer Electrolyte Fuel Cells

Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), are at the forefront of clean energy innovation due to their high efficiency, low operating temperatures, and suitability for transportation and stationary power applications. As the market heads into 2025, several key technology trends are shaping the development and commercialization of PEFCs.

- Advanced Membrane Materials: The industry is witnessing significant progress in the development of next-generation polymer electrolyte membranes. These include reinforced composite membranes and hydrocarbon-based alternatives to traditional perfluorosulfonic acid (PFSA) membranes, such as Nafion. These new materials offer improved proton conductivity, mechanical strength, and chemical stability, enabling higher operating temperatures and longer lifespans. Companies like 3M and W. L. Gore & Associates are leading efforts in this area.

- Platinum Group Metal (PGM) Reduction: Reducing the reliance on expensive platinum catalysts remains a top priority. Innovations include the use of alloy catalysts, non-precious metal catalysts, and advanced catalyst layer architectures that maximize surface area and utilization. According to IDTechEx, these advancements are critical for lowering system costs and enabling mass-market adoption.

- Durability and Lifetime Improvements: Enhancing the operational durability of PEFCs is essential for commercial viability, especially in automotive and heavy-duty applications. Research focuses on mitigating membrane degradation, catalyst poisoning, and water management issues. Toyota Motor Corporation and Hyundai Motor Company are investing in robust system designs and advanced diagnostics to extend fuel cell lifetimes beyond 5,000 hours for vehicles.

- System Integration and Miniaturization: Efforts to integrate PEFC stacks with balance-of-plant components (e.g., humidifiers, compressors, and power electronics) are resulting in more compact, efficient, and cost-effective systems. This trend is particularly relevant for portable and distributed power generation markets, as highlighted by Ballard Power Systems.

- Manufacturing Scale-Up and Automation: To meet growing demand, manufacturers are investing in automated production lines and scalable processes for membrane electrode assemblies (MEAs) and stack components. Bloom Energy and Cummins Inc. are among the companies expanding their manufacturing capabilities to support global fuel cell deployment.

These technology trends are expected to accelerate the commercialization of PEFCs, reduce costs, and expand their application scope in 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape for Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), is characterized by a mix of established multinational corporations, innovative startups, and strategic collaborations. As of 2025, the market is witnessing intensified competition driven by advancements in membrane technology, cost reduction efforts, and the scaling up of manufacturing capacities to meet growing demand in transportation, stationary power, and portable applications.

Key players dominating the PEFC market include Ballard Power Systems, Plug Power Inc., Honda Motor Co., Ltd., Toyota Motor Corporation, and Hyundai Motor Company. These companies have established strong positions through significant investments in R&D, proprietary membrane and catalyst technologies, and strategic partnerships with automotive OEMs and energy providers.

Ballard Power Systems remains a global leader, supplying PEMFC stacks and modules for buses, trucks, trains, and marine vessels. The company’s focus on durability and high power density has enabled it to secure long-term supply agreements, particularly in Europe and China. Plug Power Inc. has expanded its reach in material handling and stationary power, leveraging its vertically integrated hydrogen ecosystem and recent acquisitions to strengthen its market share.

Automotive giants such as Toyota, Honda, and Hyundai are at the forefront of commercializing fuel cell electric vehicles (FCEVs), with models like the Toyota Mirai, Honda Clarity, and Hyundai NEXO. These companies are also investing in infrastructure development and cross-industry alliances to accelerate market adoption.

Emerging players and technology providers, including Cummins Inc. (through its acquisition of Hydrogenics), Bosch, and SFC Energy AG, are intensifying competition by introducing next-generation PEMFC systems with improved efficiency and lower platinum group metal content. Additionally, collaborations between industry and research institutions, such as those fostered by Fuel Cells and Hydrogen Joint Undertaking (FCH JU), are accelerating innovation and standardization across the sector.

Overall, the PEFC market in 2025 is marked by consolidation, technological differentiation, and a growing emphasis on cost competitiveness and supply chain resilience, as companies position themselves to capture opportunities in the global transition to clean energy.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global market for Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), is poised for robust growth in 2025, driven by accelerating adoption in transportation, stationary power, and portable applications. According to projections by MarketsandMarkets, the PEFC market is expected to register a compound annual growth rate (CAGR) of approximately 18–20% from 2025 through 2030. This growth is underpinned by increasing investments in hydrogen infrastructure, government incentives for clean energy technologies, and the expanding deployment of fuel cell vehicles, particularly in Asia-Pacific and Europe.

Revenue forecasts for 2025 indicate that the global PEFC market will surpass USD 3.5 billion, with projections reaching over USD 8 billion by 2030, as reported by Fortune Business Insights. The transportation sector, especially fuel cell electric vehicles (FCEVs) from manufacturers such as Toyota Motor Corporation and Hyundai Motor Group, is anticipated to account for the largest share of this revenue, followed by stationary power generation and backup power systems.

In terms of volume, the number of PEFC units shipped globally is expected to exceed 120,000 units in 2025, with a significant portion destined for automotive applications. The Asia-Pacific region, led by Japan, South Korea, and China, will continue to dominate unit shipments due to strong policy support and the presence of leading fuel cell manufacturers such as Ballard Power Systems and Plug Power Inc.. Europe is also projected to see rapid volume growth, spurred by the European Union’s hydrogen strategy and investments in green mobility.

- CAGR (2025–2030): 18–20%

- Revenue (2025): USD 3.5+ billion

- Projected Revenue (2030): USD 8+ billion

- Unit Shipments (2025): 120,000+ units

Overall, the PEFC market in 2025 is set for dynamic expansion, with technological advancements, cost reductions, and supportive policy frameworks acting as key enablers for sustained growth through the end of the decade.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global market for Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), is witnessing dynamic growth across key regions: North America, Europe, Asia-Pacific, and the Rest of the World. Each region demonstrates unique drivers, adoption rates, and industry focus, shaping the competitive landscape for 2025.

North America remains a frontrunner in PEFC adoption, propelled by robust investments in clean mobility and government incentives. The United States, in particular, is advancing fuel cell vehicle deployment and stationary power applications, supported by initiatives from the U.S. Department of Energy. Major automakers and technology firms are collaborating to expand hydrogen infrastructure, with California leading in fuel cell vehicle registrations. The region’s market is further bolstered by the presence of key players such as Ballard Power Systems and Plug Power.

Europe is experiencing accelerated growth in PEFC deployment, driven by stringent emissions regulations and ambitious decarbonization targets set by the European Commission. Germany, France, and the UK are at the forefront, investing in hydrogen mobility, public transport, and backup power solutions. The Fuel Cells and Hydrogen Joint Undertaking (FCH JU) is a key funding mechanism, supporting R&D and commercialization. European automakers and energy companies are forming strategic alliances to scale up production and infrastructure.

- Asia-Pacific is the fastest-growing region, with Japan, South Korea, and China leading large-scale commercialization. Japan’s Ministry of Economy, Trade and Industry (METI) and South Korea’s Ministry of Trade, Industry and Energy are driving national hydrogen strategies, focusing on fuel cell vehicles, residential cogeneration, and industrial applications. China’s government-backed initiatives are rapidly expanding fuel cell bus and truck fleets, with local manufacturers scaling up production capacity.

- Rest of the World includes emerging markets in Latin America, the Middle East, and Africa, where PEFC adoption is nascent but growing. These regions are exploring fuel cell solutions for off-grid power, backup systems, and pilot mobility projects, often supported by international partnerships and development agencies.

Overall, regional market dynamics in 2025 reflect a convergence of policy support, technological innovation, and infrastructure development, positioning PEFCs as a cornerstone of the global transition to clean energy and sustainable mobility.

Future Outlook: Emerging Applications and Investment Opportunities

Looking ahead to 2025, the future outlook for Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), is marked by accelerating commercialization, expanding application domains, and robust investment activity. The global push for decarbonization and clean energy solutions is driving both public and private sector interest in PEFCs, particularly as governments implement stricter emissions regulations and offer incentives for hydrogen and fuel cell technologies.

Emerging applications for PEFCs are rapidly diversifying beyond traditional automotive uses. While passenger vehicles remain a key focus, there is significant momentum in heavy-duty transport, including buses, trucks, and trains. For instance, several major automakers and logistics companies are piloting or scaling up fuel cell-powered fleets to meet zero-emission targets and address range and refueling limitations of battery-electric vehicles in long-haul operations. Additionally, the maritime sector is exploring PEFCs for auxiliary and propulsion systems, with pilot projects underway in Europe and Asia to decarbonize shipping lanes (Roland Berger).

Stationary power generation is another promising area, with PEFCs being deployed for backup power, distributed energy, and microgrid applications. The technology’s fast start-up, high efficiency, and scalability make it attractive for critical infrastructure, data centers, and remote communities. Furthermore, the integration of PEFCs with renewable energy sources and hydrogen production is gaining traction, supporting grid stability and energy storage needs (International Energy Agency).

On the investment front, 2025 is expected to see increased funding from venture capital, corporate investors, and government grants. Major economies such as the EU, Japan, South Korea, and the US are expanding their hydrogen strategies, with dedicated funds for fuel cell R&D, manufacturing scale-up, and infrastructure deployment. Notably, partnerships between automakers, energy companies, and technology providers are accelerating commercialization and reducing costs through shared expertise and economies of scale (Bloomberg).

- Automotive and heavy-duty transport will remain the largest and fastest-growing segments for PEFC adoption.

- Stationary and portable power applications will see increased pilot deployments and early commercialization.

- Investment opportunities will be strongest in companies focused on membrane innovation, catalyst reduction, and system integration.

Overall, the outlook for PEFCs in 2025 is highly positive, with emerging applications and investment flows positioning the technology as a cornerstone of the global clean energy transition.

Challenges, Risks, and Strategic Opportunities

Polymer Electrolyte Fuel Cells (PEFCs), also known as Proton Exchange Membrane Fuel Cells (PEMFCs), are at the forefront of clean energy technologies, particularly in transportation and stationary power applications. However, the sector faces a complex landscape of challenges and risks, even as it presents significant strategic opportunities for stakeholders in 2025.

Challenges and Risks

- Material Costs and Supply Chain Constraints: The reliance on platinum-group metals (PGMs) for catalysts remains a major cost driver. Volatility in PGM prices and supply chain disruptions, exacerbated by geopolitical tensions and mining limitations, pose ongoing risks to cost reduction and scalability (Johnson Matthey).

- Durability and Performance: PEFCs must demonstrate long-term durability, especially for automotive and heavy-duty applications. Membrane degradation, catalyst poisoning, and water management issues can limit operational lifetimes, impacting commercial viability (National Renewable Energy Laboratory).

- Hydrogen Infrastructure: The lack of widespread, cost-effective hydrogen production, storage, and distribution infrastructure remains a bottleneck. This limits the adoption of PEFC-powered vehicles and stationary systems, particularly outside of select regions like Japan, South Korea, and parts of Europe (International Energy Agency).

- Competition from Alternative Technologies: Battery electric vehicles (BEVs) and other fuel cell types (e.g., solid oxide) are advancing rapidly, intensifying competition and potentially diverting investment away from PEFCs (BloombergNEF).

Strategic Opportunities

- Cost Reduction through Innovation: Advances in non-precious metal catalysts, membrane materials, and manufacturing processes offer pathways to lower costs and reduce reliance on scarce resources (BASF).

- Policy and Regulatory Support: Governments are increasing incentives for hydrogen and fuel cell adoption, including subsidies, mandates, and infrastructure investments, particularly in the EU, China, and the US (European Commission).

- Decarbonization of Hard-to-Abate Sectors: PEFCs are well-positioned to address emissions in sectors where electrification is challenging, such as heavy-duty transport, backup power, and distributed energy (U.S. Department of Energy Hydrogen Program).

- Strategic Partnerships: Collaborations between automakers, energy companies, and material suppliers are accelerating commercialization and infrastructure buildout, as seen in alliances led by Toyota Motor Corporation and Hyundai Motor Company.

In summary, while PEFCs face significant technical and market risks in 2025, targeted innovation, supportive policy frameworks, and cross-sector partnerships are creating new avenues for growth and competitiveness in the global clean energy transition.

Sources & References

- MarketsandMarkets

- Ballard Power Systems

- Toyota Motor Corporation

- European Commission

- W. L. Gore & Associates

- IDTechEx

- Hyundai Motor Company

- Bloom Energy

- Hyundai Motor Company

- Bosch

- Fortune Business Insights

- Toyota Motor Corporation

- Ministry of Trade, Industry and Energy

- Roland Berger

- International Energy Agency

- Johnson Matthey

- National Renewable Energy Laboratory

- BASF

- U.S. Department of Energy Hydrogen Program